I'm about 5 digits in debt. It's actually not that bad but considering my history with credit cards (read: I Was a Credit Card-aholic But My Marriage Saved Me), I have really painstakingly made sure I always paid my bill in full. But I didn't have an income late last year and then this year wasn't good for me, mental health-wise, so I slipped and charged a lot of food orders on my card to buy some happiness. And so here we are - fat and in debt!

Again, it's not that bad, but with all the things I pay for, I still can't pay off the full amount every month. A friend told me to take out a loan with a smaller interest rate because our credit cards here in the Philippines charge an astronomical rate of 3% interest a month. I'm still considering it.

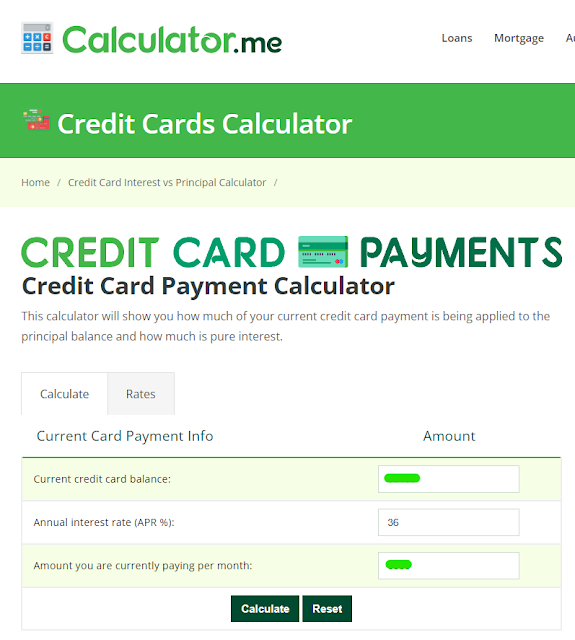

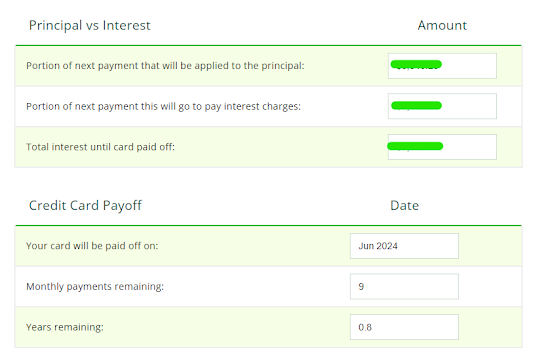

I found this useful tool online called Calculator.me when I was looking for help on how to manage my credit card bill. And the Credit Card Payment Calculator told me if I'm very, very good and very, very disciplined, I'd be able to pay off my debt in 9 months.

To empower me with this daunting task, I asked my dear Loyal Readers for some credit card advice. I've collected them all into a list. Hopefully, if you're in the same boat as I am, you'd find these tips on how to pay off your credit card debt useful, too!

1. Acknowledge Your Debt Situation

Before diving into debt repayment strategies, understand your current financial situation. Whether it's due to unforeseen circumstances or a history of credit card misuse, recognizing your debt is the first step toward financial freedom.

2. Explore Debt Consolidation Options

Consider consolidating your credit card debt with a loan that offers a lower interest rate than your credit cards. This can help reduce your overall interest payments, making it easier to pay off your debt. Like what my friend advised, I should explore options for loans with lower interest rates in the Philippines.

3. Utilize Online Tools

Online tools like Calculator.me can be incredibly helpful. The Credit Card Payment Calculator, for example, can estimate how long it will take to pay off your debt with disciplined payments. Knowing your timeline can be motivating.

4. Set Clear Goals

Establish specific and realistic goals for paying off your credit card debt. Determine how much you can afford to pay each month, and create a timeline for becoming debt-free. Having clear objectives will keep you focused on your financial journey.

5. Cut Down on Credit Cards

Consider reducing the number of credit cards you hold to prevent further accumulation of debt. Having only two credit cards is a manageable approach, ensuring you can handle your expenses without relying on multiple cards.

6. Choose Fee-Free Credit Cards:

Opt for credit cards that don't charge annual fees or waive these fees if you meet certain monthly payment criteria. Saving on annual fees can help you allocate more funds towards debt repayment.

7. Negotiate with Your Bank

If you've been a responsible cardholder, contact your bank to negotiate annual fee waivers or lower interest rates. Banks often reward loyal and responsible customers.

8. Leverage Reward Programs

Use credit cards that offer rewards for your spending. Accumulating rewards can provide some financial relief or extra perks while you work on paying off your debt.

9. Create a Budget

Establish a monthly budget that covers essential expenses such as groceries, utilities, and phone bills. Stick to your budget to ensure you have enough funds for debt repayment.

10. Pay More Than the Minimum

Always pay more than the minimum amount due on your credit card bills. Paying only the minimum prolongs your debt repayment and increases the interest you owe.

11. Opt for Interest-Free Installments

When making significant purchases like appliances, choose installment plans with zero interest. This way, you can spread the cost without incurring additional charges.

12. Prioritize Debt Repayment

If you have multiple credit card debts, prioritize paying off the one with the smallest balance or the highest interest rate. Focus your efforts on one card at a time.

My goal for 2024 is to wipe out my credit card debt. I've stopped using that card and I plan to pay more than the minimum. Hopefully, that would lessen the time Calculator.me estimated it would take for me to be debt-free. Their Family Budget Calculator can also help me with managing my finances, and soon maybe I can start saving again (their Savings Calculator is cool, too).

Wish me luck!

P.S. Thanks to Pam, Cecile, Kat, Ela, Nikki, and KC for the tips!

*Wallet and card image from Unsplash.