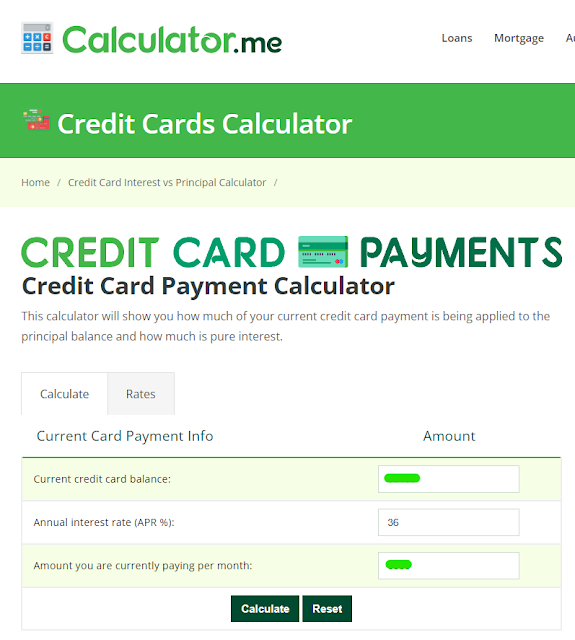

Monday, October 30, 2023

How to pay off your credit card and other useful tips

Friday, September 15, 2023

Book Review: The End of All Skies by Vincent C. Sales

This weekend is the Manila International Book Fair! That means it's the anniversary of The End Of All Skies by Vincent C. Sales! Here are a few pics of us at his book signing today at SMX. Plus, I'm finally making a book review... after one year!

|

| The boys were still so small! In just one year, they're nearly as tall as me! |

|

| Vince getting interviewed by the NBDB |

I wanted to share this joyful event with you, my dear Loyal Readers. This was such a happy day. It took Vince years to write his Filipino fantasy novel. It took years of shopping it around. It took years of prayer! And how wonderful that when the fullness of time came, his novel was published by the biggest publisher in the world, Penguin Random House!

Vince's publishing journey is not my story to tell, however. I can only tell some of it and only from a wife's point of view.

So I'll do a book review instead!

|

| I read the book while waiting outside our youngest boy's chess club. |

The End Of All Skies is a unique novel. The world building is gorgeous and it takes time to do this so be patient at the start. It's unlike any fantasy world but it's not wholly invented because if you remember all the alamat (myths) we studied way back in elementary school, it's our ancient Filipino stories, our mythical creatures, our old gods. This is why it felt spectacularly imaginative and yet familiar for me as a Filipina, but I think global readers will find it all very new.

The End Of All Skies is about how dreams big and small dreamt by people big and small can achieve something great and terrible. It's told from many points of view and the ancient Filipino names are hard to remember and there are many. It's best to read it in one sitting so you can follow all the stories. And there are many!

The destruction of the city Sun Girna Ginar is coming and we see it unfolding from all these characters affected by this great and terrible sultanate and the cruel tyrant who rules it. Whose story is real? Whose story matters? All these stories, vignettes of many lives, all fuse in the middle of the book and then, with the settings and characters established, the plot now moves very quickly. In the end, I realized each story is important because each one, no matter how short or fleeting, contributed to the downfall of Sun Girna Ginar.

The story resonated with me deeply as a Filipino. I think people who were colonized, who struggled with dictators and corrupt governments, who dealt with an alipin (slave) mentality, and who have forgotten their greatness will have a more profound connection with the story.

I was moved to tears a few times, when I read about heroes who believed the people are worth dying for, about the downtrodden who finally realized they too have power inside them then rose up and overthrew a powerful tyrant, about ordinary people who cleverly faced mythical creatures like tikbalang and gigante to achieve their goals.

It's a fascinating read! A few reviews said they found it challenging to get into, especially when they're used to just one point of view. I also think people who've never been in a position where imperialists and traitors stole everything from your country will find it fantastical. Sadly in the Philippines, this is still a frighteningly true and relevant story.

The End Of All Skies is worth reading if you're up for something new and different. And powerful and true.

The language is so beautiful, too. I am a lover of words and the words are so gorgeous, almost poetic. Sometimes I would pause and reread the sentences because they're just so pretty.

I highly recommend! Proud of this #FilipinoNovel. Proud of the Filipino story. May we #NeverForget who we are!

More reviews here at Goodreads!

If you're going to the book fair this weekend, all Penguin books are at 20% off at the giant Fully Booked booth! Buy 5 Penguin books and you get a cool Penguin umbrella!

Follow Vince on Instagram and like his Facebook page!

Buy The End Of All Skies by Vincent C. Sales from Fully Booked bookstores and Acre's Lazada. It's also available on Amazon, Kindle, Barnes & Noble, Waterstones, Blackwell's, and other global booksellers.

* * * * * * *

Monday, September 04, 2023

7 Essential Financial Skills Every Aspiring Small Business Owner Should Have

|

| My small business is writing! I enjoy being a writer and interviewing celebrities. |

Meanwhile, I also think aspiring entrepreneurs in the Philippines are facing a dynamic business environment that demands a solid understanding of financial principles. Don't just start a business without thinking of the financials! To maximize your chance of success in such a competitive environment, soon-to-be business owners like yourself need to develop sound financial skills.

A clear grasp of different financial processes and best practices empowers you to make well-informed investment decisions and confidently negotiate with clients and stakeholders. If you're thinking of starting your own small business or startup, here are seven essential financial skills you should hone to build a strong foundation for your ventures and increase your chances of long-term success and sustainability:

1. Debt Management

Understanding debt management is vital for an aspiring entrepreneur who may need to apply for a business loan to start their venture or support its growth. Developing this skill enables people to assess their borrowing needs, choose suitable financing options, and manage debt responsibly.

In a business context, effective debt management helps entrepreneurs avoid overleveraging, minimize interest expenses, and maintain a healthy credit profile. A startup company, for instance, might be presented with the option to apply for a business loan Philippines banks are making available to their commercial clients.

A startup or small business like yours may find a good fit in the Maya Flexi Loan, a business banking loan that offers low fees and enables entrepreneurs to divide Php 2 million worth of funding into separate loans. Someone with excellent debt management skills will be able to use this flexible financial product to grow their venture and create a repayment plan that aligns with their business's cash flow.

2. Budgeting

Aside from being able to manage business banking loans well, aspiring entrepreneurs should also aim to develop strong budgeting skills. Knowing how to budget your finances and the funds that you’ve received through loans allows you to effectively plan and control your resources.

If you know how to create a well-structured budget as a small business entrepreneur, you can estimate your income and expenses, allocate your resources strategically, and avoid overspending, thus ensuring your business remains financially stable. You’ll also be able to identify cost-cutting opportunities, make informed decisions about investments and marketing campaigns, and set realistic financial goals for your organization.

3. Financial Forecasting

Financial forecasting refers to your ability to predict future revenue and expenses based on historical data and market trends. When you master financial forecasting (a skill I have sadly not mastered, hence here I am, an employee again - sigh!), you can anticipate potential challenges and opportunities and make proactive decisions to stay ahead of competitors.

Business owners who’ve developed the skill of financial forecasting can play a pivotal role in creating strategies, setting achievable targets, and guiding inventory management. It’s possible to build up this skill by analyzing historical sales data, conducting market research, and employing financial modeling and scenario analysis to project different outcomes.

4. Cash Flow Management

Effective cash flow management is essential for the survival and growth of any business. If you master this skill (again, a skill I failed at because of the pandemic), you’ll likely always have cash on hand to cover daily operational expenses, manage debt, and seize growth opportunities.

The skill of effective cash flow management also helps entrepreneurs avoid shortages that may lead to missed payments or disruptions. During periods of positive cash flow, on the other hand, this skill enables businesses to invest in equipment, hire skilled employees, and fund marketing campaigns.

5. Record Keeping

An accurate and organized financial record should serve as a solid foundation for your business decisions. It’s a must, then, for aspiring entrepreneurs like you to make a habit of keeping clear records of all your business transactions, including profits, accounts receivable, and the loans for businesses that the establishment has acquired. Doing so will allow you to get a clear overview of your business's financial health at any time, thus enabling you to assess its performance in the most accurate manner.

Proper record-keeping simplifies financial statement preparation and supports evidence-based decision-making, and it also facilitates smooth audits and financial reviews. Consider learning how to use accounting software to streamline record keeping and ensure that your business always has consistent and accurate records.

It’s also a sound habit to regularly reconcile bank statements, receipts, and invoices. If you aren’t confident about your current abilities, invest in financial training or hire an accountant to ensure that your records are accurate and up-to-date.

6. Pricing Strategy

Pricing strategy refers to the ability to set the right prices for products or services, and it’s also something aspiring entrepreneurs should learn or pick up. Business owners who are able to master this skill can maximize their profitability and maintain their competitiveness. This is because a well-crafted pricing strategy can attract customers, create perceived value, and boost sales.

You’ll be able to determine optimal pricing schemes by understanding production costs, competitor pricing, and customer demand. Boost your capability to optimize pricing, and strike the right balance between profitability and customer satisfaction, by conducting market research, analyzing competitors' pricing strategies, and considering customer feedback.

7. Financial Analysis

Lastly, entrepreneurs should also be able to assess the profitability, liquidity, and overall financial health of their businesses. This skill is called financial analysis, and it allows business owners to gain valuable insights into their venture’s performance.

Financial analysis informs decision-making by helping entrepreneurs identify strengths, weaknesses, and opportunities for improvement. In a business setting, this skill aids in evaluating investment opportunities, measuring financial efficiency, and formulating growth strategies. Go into your new business venture with the desire to improve your financial analysis skills over time.

By developing these skills, entrepreneurs can create strong financial foundations for their businesses, make the most responsive business decisions, and navigate future financial challenges and growth opportunities with confidence. Knowing that continuous learning and applying these financial skills will be instrumental in achieving long-term success and sustainability for your business, aspire to hone these in your journey as an entrepreneur.